Christopher Dahl

Transitioning into data science and analytics, I am a Navy veteran with a Master of Science in Applied Business Analytics from Jacksonville University. My background includes coordinating disaster responses and managing financial operations, which has sharpened my analytical and problem-solving skills. This experience provides a strong foundation for my technical expertise in R, Python, and Tableau. As a Distinguished Graduate Business Scholar, I am well-equipped to leverage these capabilities to deliver effective data-driven solutions in this dynamic field.

Please review my resume and Project Showcase section. Reach out with any questions!

Data Driven Solutions

Navy veteran and recent MS in Applied Business Analytics graduate ready to drive innovation in Data Science and Analytics.

Contact Me

Christophereric.dahl@gmail.com ![]() Let’s connect!

Let’s connect!

About Me

I’m based in Fernandina Beach, FL, where I live with my wife, Hillary, and our Cavalier King Charles Spaniel, Sinto. In my down time you can find me shark tooth hunting and soaking up the natural beauty of Northeast Florida.

If you ever want to chat about shark tooth hunting techniques or share your favorite spots in Northeast Florida, I’d love to hear about them.

“Without data, you’re just another person with an opinion.”

― W. Edwards Deming

Projects Showcase

Through my graduate-level projects, I have honed my skills in visualizing complex data sets into actionable strategies that propel business growth. Let me help you unlock the full potential of your data through meticulous analysis and strategic interpretation.

Emergency room management

Support Vector Machines

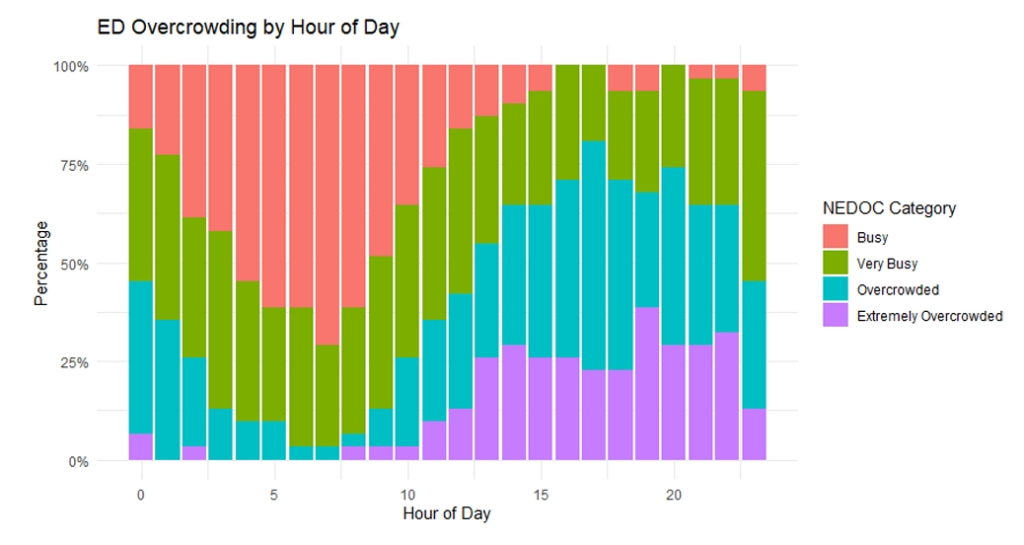

I achieved an 86.88% accuracy rate with an SVM model that predicts various levels of overcrowding in the Emergency Department (ED). This high level of accuracy provides strong confidence in recommending operational improvements and better resource management, ultimately enhancing patient care and increasing hospital revenue. These insights will drive continuous improvements in ED processes, supported by innovative technologies like telehealth services.

Emergency room management

Random Forest

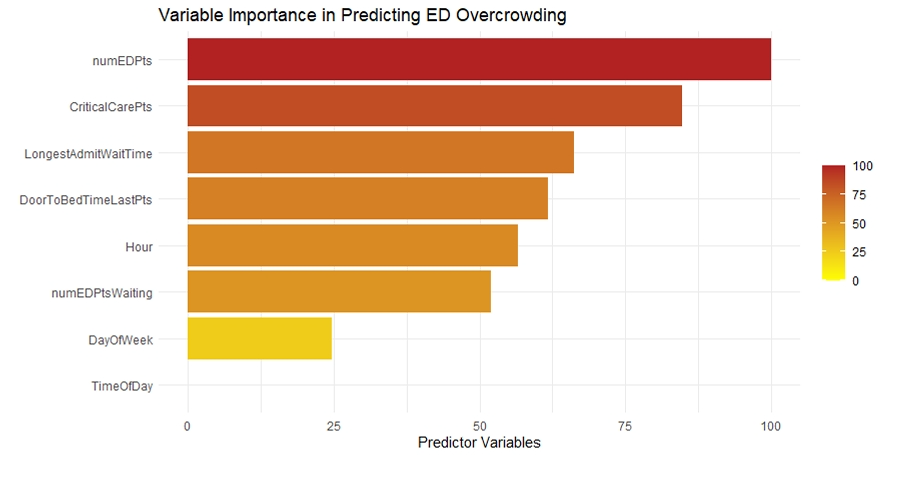

I used Linear Regression, SVM, Naïve Bayes, and Random Forest models to analyze overcrowding in a hospital’s Emergency Department (ED). These models identified key predictors of overcrowding and supported my recommendation to adopt telehealth to improve patient flow and operational efficiency, aligning with the hospital’s goal of innovative service delivery.

2023 nfl betting strategies

Digital Visualization

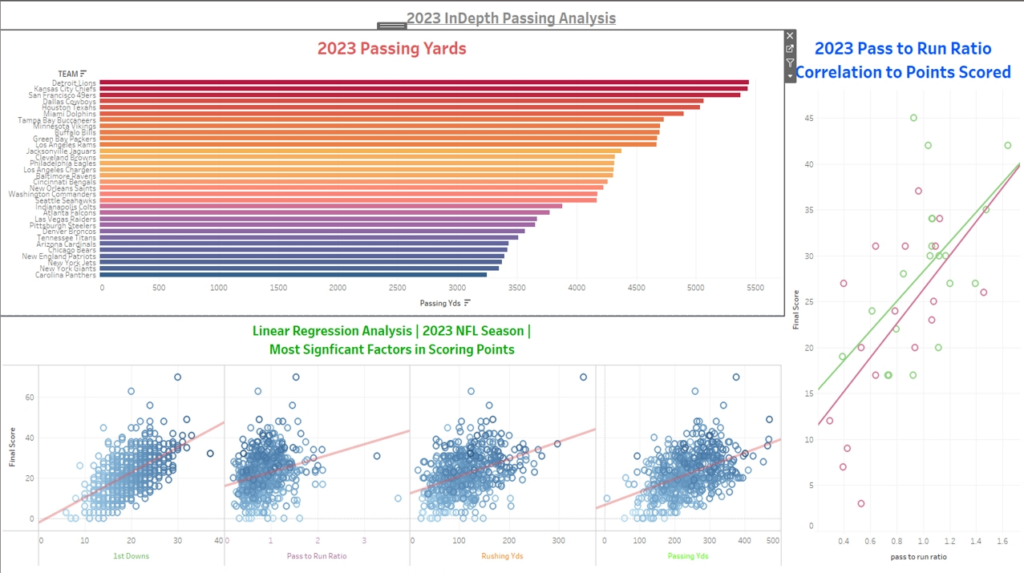

This project showcases the ability to transform complex datasets into actionable intelligence. I utilized Tableau for dynamic data visualization to dissect the 2023 NFL season statistics and betting strategies, offering insightful analytics that empower data-driven decision making for sports betting enthusiasts.

2023 nfl betting strategies

Presentation

I created this video to demonstrate the power of data-driven insights obtained through regression analysis and machine learning. Contrary to the media narrative that suggested the Jacksonville Jaguars and the 49ers had equal chances of reaching the Super Bowl, the data consistently showed the Jaguars trailing the 49ers in key statistics. This video addresses strategic questions about team performances and betting outcomes, illustrating how thorough data analysis can lead to more informed betting decisions.

Fintech risk assessment

SVM Model

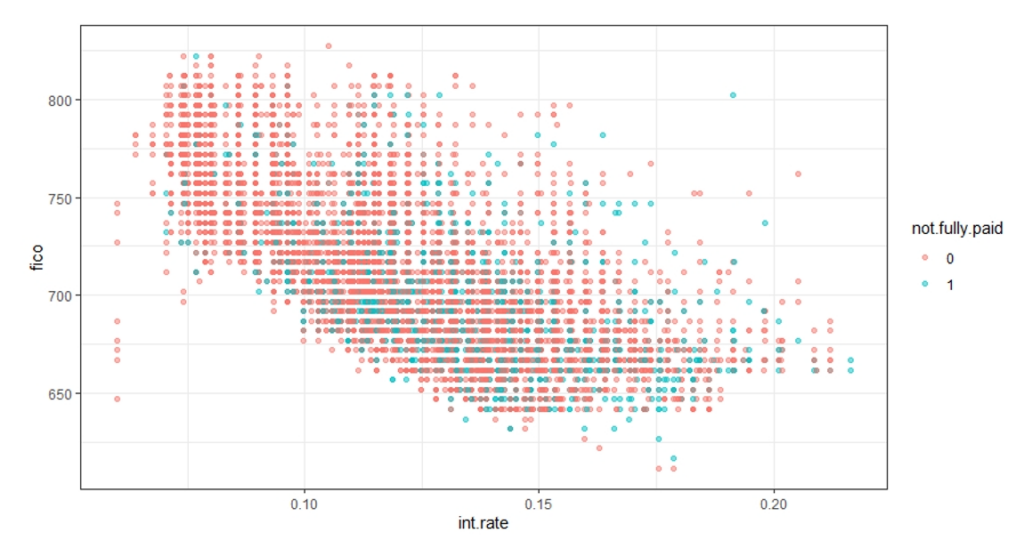

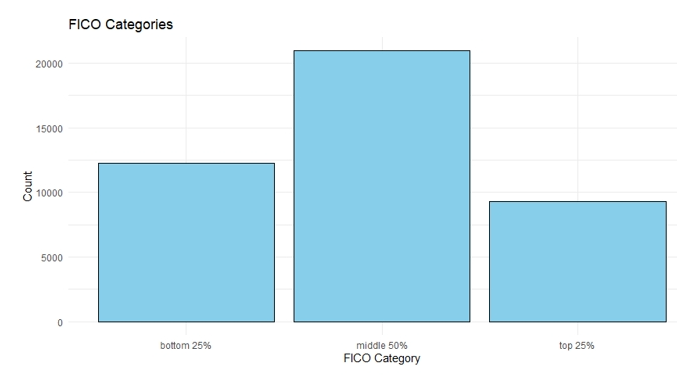

In this project, I utilized a Support Vector Machine (SVM) model, aimed at predicting loan repayment outcomes. Using R, the SVM model involved data preparation—loading libraries, cleansing, and transforming data, notably converting categorical variables to numerical form. The dataset was divided into a 70/30 training/testing split, with parameter tuning to improve accuracy. Despite a high accuracy rate, I found the model was biased towards predicting loans as not fully paid. To enhance performance and reduce bias, I recommend further parameter tuning, segmentation analysis, and employing techniques like SMOTE to balance the dataset.

Fintech risk assessment

Naïve Bayes Model

For this project, I used Naïve Bayes and Support Vector Machines (SVM) to improve decision-making in financial services. These models analyze data like FICO scores to tailor financial products, enhance risk management, and improve customer experiences. Although effective overall, both models struggle to accurately identify high-risk loans—Naïve Bayes lacks sensitivity, while SVM has low precision and recall. Insights from Naïve Bayes enhance the strategy by helping refine approaches to risky loans. My final recommendations include tightening loan approvals, adjusting credit scores, reevaluating riskier loan categories, and continuous tuning of model parameters. These steps aim to provide more personalized services and improve customer engagement.